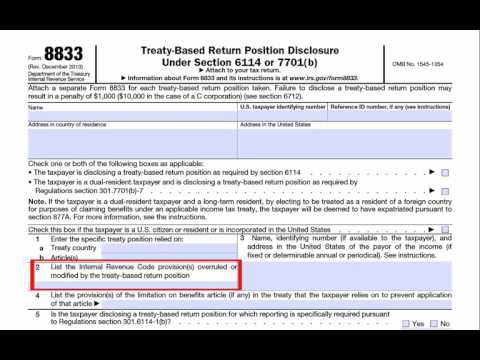

Form 8833 is used to disclose when a taxpayer is claiming that a tax treaty overrides some US tax rule. Claiming treated benefits for some purposes does not require Form 8833 to be filed. For example, claiming that an income tax treaty modifies the taxation of certain pensions or Social Security does not need to be disclosed on Form 8833. However, claiming treated benefits for other purposes specifically must be disclosed on Form 8833. For example, claiming that a treaty non-discrimination provision overrides some US tax rule specifically must be disclosed on Form 8833. The top of the form indicates that a separate Form 8833 must be filed for each treaty-based return position taken. Also, there is a penalty of $1,000 for failing to file the form when required to do so. The penalty is $10,000 in the case of a c-corporation. Note that if you are unsure whether you need to file a Form 8833, it is generally better to file the form. There is no penalty for including the form when it was not needed. At the top, you put your name and US taxpayer identification number. The reference ID number is generally only applicable to foreign corporations. You put your foreign address and/or your US address. The next section has two checkes for you to check. The first is for positions required to be disclosed under Section 611. The second is for dual resident taxpayers who are required to file Form 8833 under the residency regulation. Most of the time, you would check the first check. If you are a dual resident taxpayer, you would check the second check. The note below these checkes includes an important reminder for dual resident taxpayers who are long-term green card holders. That is, if they claim they are not US residents under a...

Award-winning PDF software

S 8833 and 8854 Form: What You Should Know

Mark does not need to report income earned and expenses on Form 8854 for the 5-year period. (He is only subject to Form 8946 and his home country is not on IRS E-file and/or Form 8946 reporting requirements) Long Term Residents. It is important to know that long term residents have only 1 year after they attain US Green Card holder status to be able to file Form 8854, and then they are required to file another form and file again in one year. Green Card holders residing in US without an alien Form 8854 may file Form 8849 when eligible, but they may have to file an annual Expatriation Statement annually to report income earned and expenses on Form 8854 or the annual U.S. tax return if they have a home Citizens must file Form 8849 Form 8849 is only available to USCIS (U.S. Citizenship and Immigration Services). You are required to file Form 8849 if a U.S. citizen does any business in a foreign country. For example, if an American citizen in the UK (or other country) acquires assets in another country, and does not declare this and withdraw his US nationality by the 15th of the month following acquisition, then the American citizen must file Form 8949 to report these assets. Form 1128. For Long-Term Resident Investors: A Resident Tax Filing Penalty and Interest and Form 8337. Long Term Resident investors have two separate filing paths with two different penalties. For investors that are U.S. Citizens, the first filing path is with their investment company and not a taxpayer. The Form 8337 is a penalty-free filing from an IRS filing. You are not required to file Form 8337, but you will owe an 10% penalty to the IRS and 10% interest on the Form 8829 (tax due) for each year of failure to file. For Non-US Citizens who are investors, the second filing path is a taxpayer and Form 8347 if an individual or a joint return. If you are an individual and want to file a Form 8347, then you will need a U.S. taxpayer ID card (not a credit card). If you have a joint return, then you will need to submit Form 8447 and also file Form 8859.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8854, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8854 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8854 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8854 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Forms 8833 and 8854