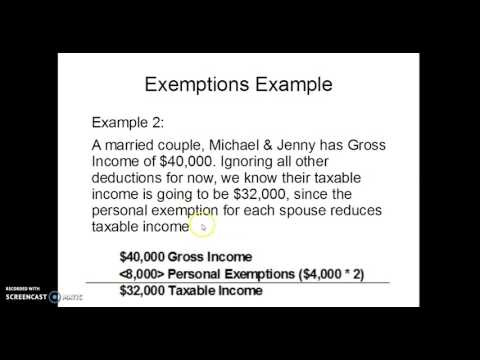

So we'll start by taking a look at the exemptions, the personal and dependency exemptions. The personal and dependency exemptions are items that can reduce a person's taxable income. We will first cover the personal exemption, which is an amount that a taxpayer can use for themselves or their spouse. This exemption is a specified sum that is adjusted annually for inflation. In 2015, the exemption amount is $4,000. The personal exemption can be used by the taxpayer and their spouse to reduce their taxable income. Next, we will discuss the dependency exemption. This exemption is used when a taxpayer has dependents that they can claim. Each qualifying dependent can provide a tax break and reduce the taxpayer's taxable income. For example, if a taxpayer has a son who is a dependent, they can claim a dependency exemption for him. The exemption amount for 2015 is $4,000. It is important to note that only one exemption can be used for each taxpayer, even if the taxpayer shows up on multiple tax returns. If a taxpayer is claimed as a dependent on someone else's tax return, they cannot claim a personal exemption on their own tax return. This ensures that there is no double-dipping and that there aren't multiple exemptions for the same taxpayer. Let's look at some examples to understand how exemptions work. In the first example, a single taxpayer has a gross income of $10,000. Ignoring all other deductions for now, their taxable income is reduced to $6,000 by the personal exemption. In the second example, a married couple, Michael and Jenny, have a gross income of $40,000. Ignoring other deductions, their taxable income is reduced to $32,000 by the personal exemptions for each spouse. In the third example, Michael and Jenny have a dependent son named Kyle. Their gross income is still $40,000,...

Award-winning PDF software

Video instructions and help with filling out and completing Which Form 8854 Residency