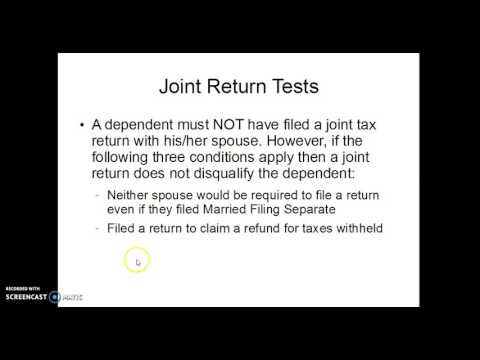

All right, so we'll look at the two additional tests that need to be met by both qualifying child and qualifying relative. So, this is what these are. In addition to me, they're unique tests for the qualifying child and qualifying relative. The qualifying child or relative must also meet the following two tests, which are common to both. What we looked at before were the unique tests. The qualifying child has four unique tests, and the qualifying relative has four of its own unique tests. On top of that, these two tests are common to both. These need to be looked at for every single dependent we're considering. We need to make sure they satisfy these tests, in addition to the other tests for the qualifying child or qualifying relative. The first common test is the joint return test. Basically, this test states that the dependent could not have filed a joint tax return with his or her spouse. If they did file a joint tax return with their spouse, in general, they cannot qualify to be someone else's dependent. However, there are a few exceptions. This word should be "the following two conditions" instead of "these three conditions." There are two conditions that we need to be aware of. If these conditions are met, it's okay to file a joint return with your spouse and still qualify to be someone else's dependent. These conditions are: if you filed a return to claim a refund for the taxes withheld, or if neither spouse would be required to file a return, even if they filed married filing separately. This one is a little bit harder to understand, especially right now, but just be aware of it. It will make more sense when you look at the filing statuses. So, in general, when...

Award-winning PDF software

Video instructions and help with filling out and completing Where Form 8854 Residency