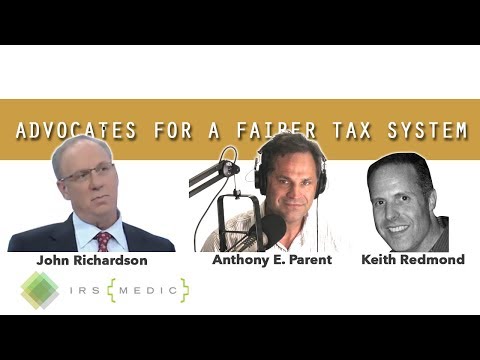

Hi, thanks for joining me today. I have two special guests, John Richardson and Keith Redmond, both global advocates for Americans overseas. We are trying to get this tax code to make a little bit more sense. Gentlemen, thank you for joining us today. We have a few updates on the territorial tax jurisdiction proposals that are headed to Congress. Thank you for joining me today. So John, we have some interesting things going on. We were promised a territorial tax for individuals back with tax reform, and what we got was a little bit different. Some nasty surprises and a little bit different, I mean the complete opposite. Why would you say kind of happened in tax reform with TTFN? How would you explain it? Well, I would explain it very simply that the interests of individual Americans abroad were simply not considered, period. I don't think it's any more complex than that. Indifference being of course the worst form of abuse. So they began by not considering Americans abroad and then enacted some incredibly unanticipated complex tax reforms that have affected Americans abroad so negatively that for those who have been sitting on the fence about whether to renounce US citizenship, I think it's sort of removed all doubt. One of them would be, of course, this transition tax thing which affects many Americans abroad who are shareholders of small foreign businesses, meaning non-US businesses. You know, without getting into the details, it's a way of punishing them retrospectively. And then, in addition to that, they included a new provision called, I suppose appropriately, the "Forrest Grattus Freudian Slip of All Time," guilty, which would punish them prospectively. So they didn't consider them, but they enacted laws which punish Americans abroad for their past and make their future as Americans...

Award-winning PDF software

Video instructions and help with filling out and completing When Form 8854 Taxation