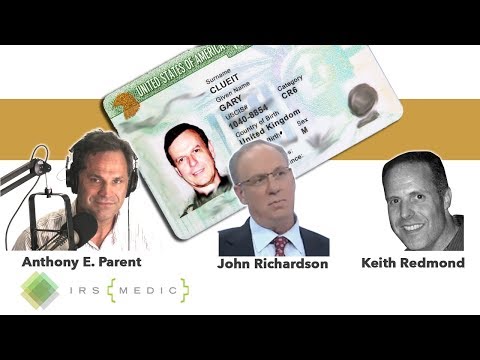

Hi, this is Anthony, parent of Parent & Parent LLP. We've talked a lot about tax problems and how they affect US citizens, but we haven't discussed how citizenship-based taxation and FATCA have impacted green card holders and the problems they create. Today, we have a guest, Gary Cluett, a green card holder who has experienced the worst of the IRS compliance regime. Also joining us are John Richardson of Citizenship Solutions and Keith Redman, a global advocate for American overseas individuals. Welcome, Gary. Thank you for joining us today. I'd like to hop into your story. Could you tell us a little bit about how you came to America and how your tax situation unfolded? Sure, Anthony. I've been in the United States for a total of 34 years. I was originally living in Australia as an Australian resident. I was hired by a US company due to my specific expertise and came over on a work visa. However, the company decided it was too much effort to keep renewing the work visa, so they hired a lawyer and applied for permanent residence. After about four years, I acquired a green card. I have been a tax resident of the United States for many years, bringing capital and expertise to the country. I started several companies and now I am in the process of semi-retiring. I have businesses in five countries on three continents, which is already challenging. Before coming to the US, I lived and worked in several other countries, and each time I would file partial year tax returns for the country I was leaving and the country I arrived in. In 1984, I filed a final year return in Australia and a partial year return in the US. Australia never contacted me or required any additional...

Award-winning PDF software

Video instructions and help with filling out and completing Can Form 8854 Blog